What are Externalities?

Externalities are the phenomena in which the occurrence takes place due to the production or consumption of some commodities, and the effect of which falls on any of the third parties who are not directly related to the production or consumption process, but somehow or the other they are affected due to the activities carried out either by the consumer or by the producer.

Externalities can be mainly of two types: one is called the positive externality which causes benefit to the society due to the activity carried out by the producer or the consumer, and the negative externality causes the cost to the third parties or to the individuals who are not directly related to the activity that is being carried out. As the name suggests, for both the externalities positive and negative, positive externalities cause something good to the society which leads to social benefit. On the other hand, negative externalities are something that causes trouble to others.

Externalities in society take place usually when the market does not work according to its mechanism which is generally called market failure. This means that the market fails to allocate the cost and benefit of the society in the proper manner which results in imbalance or disequilibrium in the society in terms of the income distribution of commodities, etc.

One of the main reasons for which externalities in society take place is due to the fact of property rights. If someone is having any kind of property rights over a specific kind of property then he or she can use it either for the benefits of the society which is popularly known as the social benefit or external benefits or for producing private benefits but causing external costs.

Positive Externalities

Positive externalities take place when there exists a benefit of the society and the individual who is creating that positive externality is not compensated for the good that he or she is doing for society. But some way or the other the locality or the area where the individual is residing is creating some kind of benefit to others.

The concept of positive externalities can be understood with the help of an example. Suppose an individual has completed his or her studies and has decided to provide free education to the children residing in a particular area. This initiative taken by the individual is particularly for the underprivileged group of children in society. Therefore, when the individual initiates the plan of building a school, this means that the society is getting benefitted but in return, the individual is not getting the compensation that he or she should get for creating the benefit to the society instead of social cost.

In simple words, it can be said that when some kind of activity is carried out and that creates some kind of social benefit to the people of an area and the person who is creating this positive externality is not getting compensated then it can be said that an externality is created but in a positive sense.

Some of the examples of positive externalities in society include public goods which become available due to government intervention.

Negative Externalities

Negative externalities take place in society when the production of any good produces external cost to the third party who is not even directly involved in the production process. In other words, it can be said that negative externalities are the spillover cost that has to be built by the third party. The concept of negative externalities can be understood with the help of an example. Let us assume that there is a leather factory and this factory is closely located in an area from where there is a nearby river flowing. Now, their emission of smoke is occurring which is causing air pollution and there is a discharge of the pollutants or wastes happening which is flowing into the river. Now the river is the source of drinking water for a lot of people residing near the river. Now, when the wastes are flowing into the river the health of the individuals for whom the source of drinking water is the river, is getting affected.

Hence the cost of getting treatment by the doctor is being beard by those individuals who are getting ill after drinking the polluted water and for which the producer is not even compensating them with anything and neither there is any kind of external cost that is being imposed on the producer of the leather factory for creating such external cost to the third parties who are not even involved in the production of leather in any way. Also, the leather factory is producing air pollution which is causing many kinds of respiratory diseases to the individuals staying near to that place.

In most cases, it is seen that due to the presence of negative externalities, businessmen or industrialists get a private benefit. But the external cost that they are causing in the environment or to the locality, for that reason they do not have to pay any kind of private costs for compensating with it.

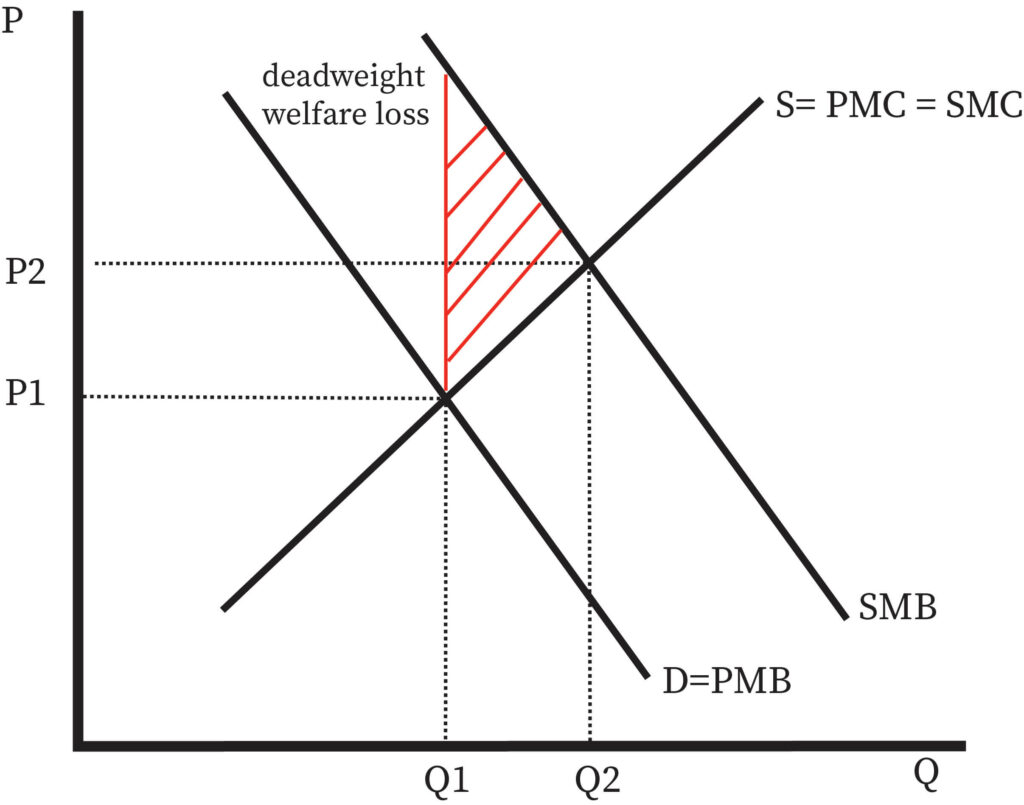

Therefore, to curb the negative externalities to some extent Pigouvian tax can be imposed. Pigouvian tax is that kind of tax that gets imposed on the producers or industrialists or businessmen who create an external cost to the society. This external cost is mainly found in terms of pollution, damage to health, congestion in the society, and so on. The Pigouvian tax was discovered and formulated by Pigou, who used various methods to design this kind of tax where the society will also get some kind of compensation due to the external cost that is being created by industrialists or businessmen for the production of goods and services.

Similarly, there should be some concession or benefits that an individual should get for creating positive externalities as well in the society. Therefore, the government should provide some kind of subsidies to those who are creating positive externalities either by consumption or by production.

The above discussion has been done from the point of view of production. Now let us see how there can be positive and negative externalities when some kind of consumption activity takes place. This is popularly known as consumption externalities.

Positive Externality during Consumption

Positive externality during consumption takes place when an individual consumes certain specific types of goods and services but the benefit is spill over to the society in a positive way which actually benefits the people residing in that particular area where the individual also resides. This can be understood with the help of an example. Let us assume that an individual does the consumption of education service by learning any kind of subject. Now in the long run he or she decides to teach the underprivileged children of the society for free. This is causing external benefit to the society but the individual is not getting compensated for that. Therefore, he is or she is doing the consumption of education service but is causing positive externalities to the society.

Negative Externalities during Consumption

Negative externalities during consumption take place when an individual does consumption of such a thing which can cause the external cost to the society but will cause private benefit to the individual who is doing the consumption. In this case, the third party is bearing the cost for the private benefit that the individual is getting or will get from the consumption of so and so products or goods. This can be understood with the help of an example. Suppose in a locality someone is playing loud music. This will not only cause noise pollution but will also affect those who have heart issues especially the old people residing in that area and also it will affect babies. Since the music is assumed to be excessively loud it can also cause loss of hearing sense to some people. But for this external cost that is being created by the individual who is playing music and by that who is getting the private benefit, will not at all compensate for causing such kind of pollution or health issues to some of the individuals who are staying in the neighborhood.

Therefore, in conclusion, it can be said that to have control over externalities both positive and negative, government intervention is extremely important. The government can either impose taxation on the industrialist or businessmen who are causing private benefit but external costs to the society. Also, the government can provide subsidy to the individuals who are creating positive externalities and also causing social benefits to the third parties without getting compensated for what he or she is doing.

Context and Applications

This topic is significant in the professional exams for both undergraduate and graduate courses, especially for

- BA in economics

- MA in economics

- BBA

- B.Com

- M.Com

Want more help with your economics homework?

*Response times may vary by subject and question complexity. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers.

Positive and Negative Externalities Analysis Homework Questions from Fellow Students

Browse our recently answered Positive and Negative Externalities Analysis homework questions.