Concept of Financial Statement Analysis

Financial statement analysis can be defined as the process of analyzing the financial statements of the company for the purpose of making decisions. Stakeholders of the company conduct financial system analysis for three major purposes namely to understand the financial health of the organization, to know its performance and understand the value of the business.

What is a Financial Statement?

Financial statements are written documents which explain the financial activities of the business. It is prepared at the end of a particular financial cycle. It shows the financial position and profitability of the business. Financial statements have three main components namely income statement, balance sheet and statement of cash flow.

Balance sheet: Balance sheet is a statement which shows the financial worth of a company in terms of book value. Balance sheet statements can be divided into three major parts namely assets, liabilities and shareholder’s equity.

It shows the financial position of the business. Assets minus liabilities must balance with the shareholders equity figure. This figure is of priority for a company as it varies with the company’s financial activities.

Income statement: it is also known as profit and loss statement. It shows the performance of the company for a specific period of time. It records the income and expenses of the company. The ending figure shows the net profit or loss earned by the company for the particular period.

Cash flow statement: Cash flow statement records inflows and outflows of cash. It gives an overview of flow of cash from operating, investing and financing activities. This particular statement is of priority for the business as it shows the available cash on hand and liquidity position of the organization.

Features of the Financial Statement Analysis

Analysis helps to present the complex data of financial statements in simple and understandable form. Financial statement analysis helps in decision making by comparing past and present data. Information in the financial statements is converted into usable form to match the requirements of the users.

Purpose of Financial Analysis

Financial analysis serves the following purposes:

- Basic purpose of analysis is to know the strength and weakness of the business and know the position and profitability of the business.

- Financial statement analysis also helps in knowing the present and future earning capacity of the business.

- To know efficacy of the operation of various departments within the organization,

- To make a comparison of firms both internally and externally.

- To understand the financial stability and liquidity position of the business

Importance of Financial Statements Analysis

Financial analysis helps to know the financial position, performance, and profitability and future aspects of the business. Financial statement analysis is done by using various methods.

From the management view point, financial analysis plays a significant role because analysis can be used for the various purpose like evaluating the trend of production and sales of the business and pricing policies of the business, examining the performance of the various departments and business as a whole, to control and prevent wastage, comparing the business activities and forecasting, determining the strength and weakness and making suitable decisions.

Financial analysis is not only important for the management but also for outsiders like creditors, potential investors and stakeholders. Apart from this, creditors, banks, financial institutions also use financial statements in order to know the credibility and short term and long-term financial position of the business.

Government also conducts financial analysis for administration purposes. Economists use financial statement analysis for forecasting, budgeting, and deciding future line of action to be taken by the government. Employees within the organization also use financial statements to understand the performance of the organization.

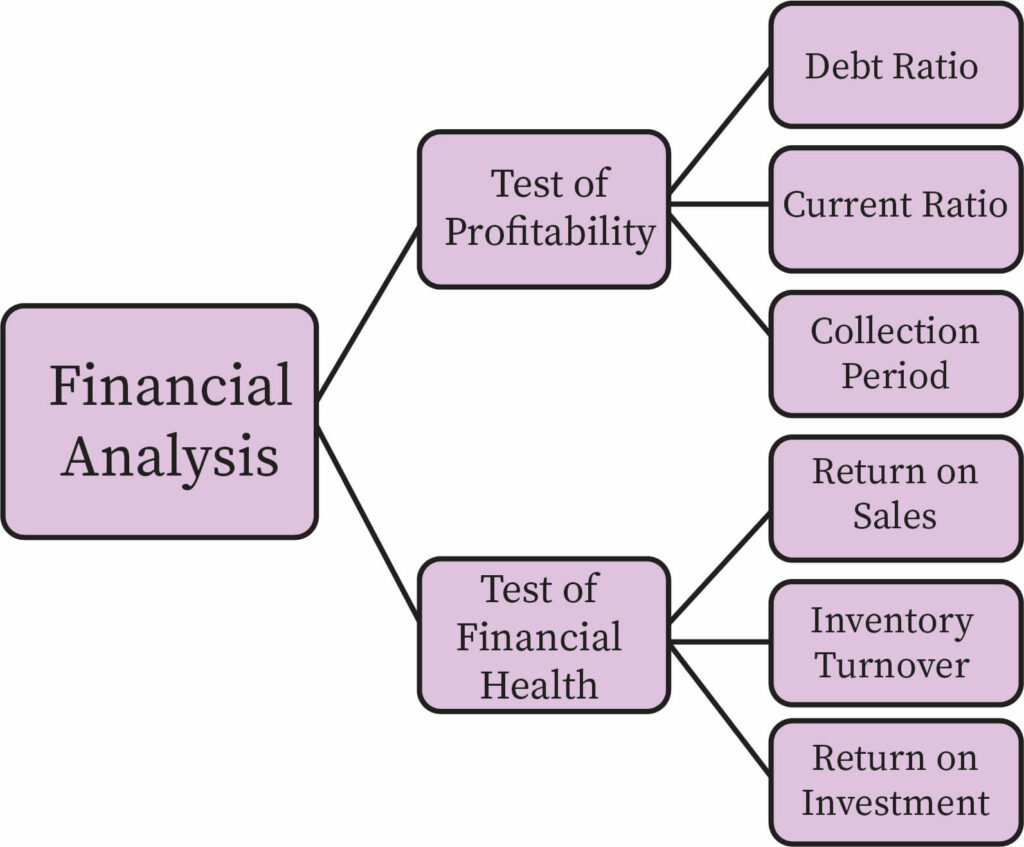

Types of Financial Analysis

Types of financial analysis can be classified into two types namely based on material used and the other one is on process of analysis

On the basis of material it is further classified into following types:

1. Internal analysis is done by the people who have access to the books of accounts of the company and the related information of the company. Those persons are management of the company, shareholders and employees. Hence this is considered to be a reliable form of analysis.

2. External analysis: This analysis is done by the outsiders of the company who have no access to the books of accounts of the company. Those external parties are creditors, investors, banks, and financial institutions. They depend upon the financial data published by the company. Such analysis is not that reliable as internal analysis because of limited availability of information.

On the basis of process of analysis financial analysis can be classified into two:

1. Horizontal analysis: This analysis is also known as dynamic analysis. In this analysis financial statements of more than one year are considered and compared. Components of financial statements of the current year are compared with the previous years and the increase and decrease of the items are expressed in the percentage. Such analysis can help us in understanding the business trend. Also it shows the strength and weakness of the business.

2. Vertical analysis: Ratio analysis is a tool used for these purposes. Various types of ratios like current ratio, gross profit ratio are used. It is also known as static analysis because analysis is made based on the record of one year

Both horizontal and vertical analysis should be made because they are complementary in nature.

Limitation of the Financial Statement Analysis

Financial statement analysis suffers from following limitations:

- One of the most highlighted limitations of the financial analysis is that it ignores the qualitative aspects; it does not show the quality skills, technical know-how of the management and employees.

- There are different tools of analysis and results are of different kinds which can create confusion in the mind of the users.

- It also ignores the price level changes because it is not accounted in the financial statements. Change in price affects the production level, sales and value assets.

- Financial analysis is based on the records of the past events and on the basis of the past event forecasting for the future cannot be done with confidence.

Financial statement analysis is prone to both benefits and limitations. But benefits outweigh the limitations. Hence it is always better for any organization to conduct financial statement analysis to enjoy its benefits.

Context and Applications

This topic is significant in the professional exams for both undergraduate and graduate courses, especially for

- BBA

- MBA

- Bachelor of Commerce

- Master of Commerce

Want more help with your accounting homework?

*Response times may vary by subject and question complexity. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers.

Search. Solve. Succeed!

Study smarter access to millions of step-by step textbook solutions, our Q&A library, and AI powered Math Solver. Plus, you get 30 questions to ask an expert each month.

Financial Statement Analysis Homework Questions from Fellow Students

Browse our recently answered Financial Statement Analysis homework questions.

Search. Solve. Succeed!

Study smarter access to millions of step-by step textbook solutions, our Q&A library, and AI powered Math Solver. Plus, you get 30 questions to ask an expert each month.