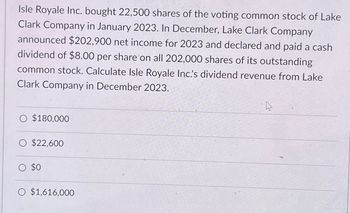

Isle Royale Inc. bought 22,500 shares of the voting common stock of Lake Clark Company in January 2023. In December, Lake Clark Company announced $202,900 net income for 2023 and declared and paid a cash dividend of $8.00 per share on all 202,000 shares of its outstanding common stock. Calculate Isle Royale Inc.'s dividend revenue from Lake Clark Company in December 2023. O $180,000 O $22,600 ○ $0 O $1,616,000

Q: On June 30, 2023, Wisconsin, Incorporated, issued $143,250 in debt and 24,100 new shares of its $10…

A: Consolidation -Financial reports from subsidiary companies are assembled and subsequently…

Q: Glitter Enterprises started the period with 70 units in beginning inventory that cost $2.30 each.…

A: Under the LIFO cost flow method, the most recent purchase of inventory is taken into consideration…

Q: Harold and Maude were married and lived in a common-law state. Maude died in 2018 with a taxable…

A: A tax levied on the transfer of a deceased person's taxable estate is known as an estate tax. Prior…

Q: Scrappers Supplies tracks the number of units purchased and sold throughout each accounting period…

A: It is the stock held for sale to customers. The inventory comprises of raw materials, work in…

Q: i need the answer quickly

A: Accurate financial data is essential for stakeholders and investors to evaluate a company's…

Q: Use the following information for Exercises 25-27 below. (Algo) [The following information applies…

A: Income Statement: It is a part of the financial statement of a company in which revenue and expenses…

Q: Consultex, Incorporated, was founded in 2018 as a small financial consulting business. The company…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: Only typed solution

A: The objective of the question is to calculate the cost of goods sold (COGS) for the month of June…

Q: (Appendix 6B) Inventory Costing Methods: Periodic LIFO Filimonov Inc. has the following information…

A: LIFO method is one of the methods of inventory valuation in which it is assumed that recent or new…

Q: Exercise 1-15 (Algo) Traditional and Contribution Format Income Statements [LO1-6] The Alpine House,…

A: The income statement can be prepared using various methods as variable and absorption costing. The…

Q: Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and…

A: Shareholder's EquityThe amount available for the shareholders in the company is called shareholder's…

Q: Barfield Corporation prepares business plans and marketing analyses for start-up companies in the…

A: Overhead is indirect costs incurred while producing goods or services. Overhead costs cannot be…

Q: Munoz Corp.'s books showed pretax financial income of $3,600,000 for the year ended December 31,…

A: federal income tax liability on its December 31, 2025 balance sheet= [Gain on involuntary conversion…

Q: John Peter is aware that there is no Capital Gains tax in Jamaica. He decided to buy a large piece…

A: Gain:In accounting, gain refers to the amount when the market value of the asset is greater than the…

Q: Oahu Kiki tracks the number of units purchased and sold throughout each accounting period but…

A: The last in first out and first in first out are the inventory valuation methods, according to LIFO…

Q: On October 15, 2023, the board of directors of Martinez Materials Corporation approved a stock…

A: 1. Martinez's stock option measurement date is the date on which the fair value of the stock options…

Q: Tamar owns a condominium near Cocoa Beach in Florida. In 2022, she incurs the following expenses in…

A: Solution:- The scenario involves Tamar, the owner of a condominium near Cocoa Beach Florida, facing…

Q: Kelvin owns and lives in a duplex. He rents the other unit for $680 per month. He incurs the…

A: For tax purposes, Schedule A records the expenses related to mortgage or home loan interest, state…

Q: aris Ltd deals in garden pots and figurines. All sales are conducted on a credit basis and no cash…

A: ALLOWANCE FOR DOUBTFUL DEBT ACCOUNT Allowance for Doubtful debt Account is Considered as Contra…

Q: During its first year of operations, Chocolate Passion earned net credit sales of $393,000. Industry…

A: A company may use the allowance method to record its uncollectible accounts receivable.. Under the…

Q: Current Attempt in Progress The financial data for Sunland Drilling Ltd. are as follows (amounts in…

A: The objective of the question is to calculate the current and quick ratios for Sunland Drilling Ltd.…

Q: Copr Goedl 2022 Sheba Industries reported the following budgeted sales in units for the first…

A: The objective of the question is to calculate the total number of units to be produced in July for…

Q: The following data apply to Pro Beauty Supply Incorporated for May, Year 2: Balance per the bank on…

A: The unadjusted cash balance is the amount of cash balance shown on the company book without making…

Q: Banchero Corp. purchases an investment in Kleber Co. at a price of $20.0 million. This represents a…

A: The company can make investments in other companies. The company can use the equity method to…

Q: FreshPak Corporation manufactures two types of cardboard boxes used in shipping canned food, fruit,…

A: Sales budget is the statement which is prepared by the entity for the purpose of estimating the…

Q: a. Prepare a differential analysis report for the proposal to replace the machine. Include in the…

A: Differential method of comparing 2 alternative proposals:The differential cost technique is used in…

Q: 100% complete; conversion 60% complete Costs transferred in during the month from the preceding…

A: Equivalent units of production:An equivalent unit of production is a term used to describe a…

Q: Crane Ltd. had the following items in inventory as at December 31, 2024: Item No. Quantity Unit Cost…

A: Under the lower of cost and NRV method of recording the inventory, the inventory is recorded at the…

Q: Annenbaum Corporation uses the weighted-average method in its process costing system. This month,…

A: EQUIVALENT UNITS OF PRODUCTION Equivalent Production is represents the production of a process in…

Q: The following financial information relates to Sunland Enterprises Inc. (amounts in thousands): 2022…

A: The debt-to-equity ratio (D/E ratio) depicts how much debt a company has compared to its assets. It…

Q: The Pearl Company issued $210,000 of 9% bonds on January 1, 2025. The bonds are due January 1, 2030,…

A: The bonds are issued to raise the money from the market or investors. Bonds are issued at a premium…

Q: A condensed income statement by product line for Crown Beverage Inc. indicated the following for…

A: Differential analysis is a decision-making method that examines the net effects of two options by…

Q: [The following information applies to the questions displayed below.] Following are transactions of…

A: Notes indicate a written consent of the customer which contains the detailed statement of the…

Q: In 2018, PepsiCo, Inc. acquired SodaStream, a sparkling water maker, for $3,343 million in cash. At…

A: The merger is the process of combining two in one, it means two existing companies come together to…

Q: me (formerly known as LimeBike), located in San Mateo, California, is a startup founded in 2017. Its…

A: Capitalization vs. Expensing -The main distinction between capitalization and expensing is that the…

Q: The following information pertains to Towers Corporation: • From 20X1 through 20X3, Towers had…

A: To calculate the balances in the deferred income tax related accounts for Towers Corporation for…

Q: Assume the bonds in were issued for $644,636 and the effective-interest rate is 6%, prepare the…

A: The objective of the question is to prepare the company's journal entries for the issuance of bonds…

Q: Pirate Corporation purchased 100 percent ownership of Ship Company on January 1, 20X5, for $289,000.…

A: Equity method is an accounting method wherein the investment is initially recognized at cost and…

Q: >Decision Case F:3-1 One year ago, Tyler Stasney founded Swift Classified Ads. Stasney remembers…

A: Income statement forms part of the financial statement of the company as it represents the financial…

Q: Mikaere's basis in the Jimsoo Partnership is $59,500. In a proportionate liquidating distribution,…

A: If the two parcels of land had been inventory to Jimsoo, the tax consequences to Mikaere would…

Q: Retained Earnings Titanic Corporation’s net income for the year ended December 31, 2022, is…

A: The objective of the question is to prepare the retained earnings statement for Titanic Corporation…

Q: When Patey Pontoons issued 6% bonds on January 1, 2024, with a face amount of $600,000, the market…

A: "Since you have asked a question with sub-parts more than three, as per guidelines, the first three…

Q: Budgeted sales 200 units Selling price $ 260.00 per unit Variable cost Fixed costs $ 240.00 per unit…

A: Margin of safety:Margin of safety is the difference between the company's gross revenue and the…

Q: Wyckam Manufacturing Incorporated has provided the following estimates concerning its manufacturing…

A: A planning budget for production or manufacturing unit is a vital tool. It enables the companies to…

Q: Data Trevor Cycles manufactures chainless bicycles. On March 31, Trevor Cycles had 206 bikes in…

A: Budget is the estimation of revenue and expenses prior to starting the operation. To manage the…

Q: Exercise 5-12 (Algo) Multiproduct Break-Even Analysis [LO5-9] Olongapo Sports Corporation…

A: Marginal Costing is a costing technique wherein the marginal cost, i.e. variable cost is charged to…

Q: b. What is the probability exactly one of the four audited had a charitable deduction of more than…

A: you are taking a small sample of the population without replacement

Q: Alpesh

A: The process of closing a business and distributing its assets is called liquidation. The assets are…

Q: On January 1, 2024, Presidio Company acquired 100 percent of the outstanding common stock of Mason…

A: ConsolidationThe combination of one or two elements is called consolidation. When a company acquires…

Q: Filimonov Inc. has the following information related to purchases and sales of one of its inventory…

A: Under FIFO method, inventory purchased first is considered as sold first and latest purchased…

(Give the exaplanation of formula and concept.do not provide plagarised content otherwise i dislike)

Isle Royale Inc. bought 22,500 shares of the voting common stock of Lake Clark Company in January 2023. In December, Lake Clark Company announced $202,900 net income for 2023 and declared and paid a cash dividend of $8.00 per share on all 202,000 shares of its outstanding common stock. Calculate Isle Royale Inc.'s dividend revenue from Lake Clark Company in December 2023.

○ $180,000

○ $22,600

○ $0

○ $1,616,000

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Cash dividends on the 10 par value common stock of Garrett Company were as follows: The 4th-quarter cash dividend was declared on December 21, 2019, to shareholders of record on December 31, 2019. Payment of the 4th-quarter cash dividend was made on January 18, 2020. In addition, Garrett declared a 5% stock dividend on its 10 par value common stock on December 3, 2019, when there were 300,000 shares issued and outstanding and the market value of the common stock was 20 per share. The shares were issued on December 24, 2019. What was the effect on Garretts shareholders equity accounts as a result of the preceding transactions?

- Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares of 10%, 100 par, nonconvertible preferred stock outstanding, on which the years dividends had been paid. At the beginning of 2019, the company had 7,000 shares of common stock outstanding. On April 2, 2019, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2019. Common dividends of 17,000 had been paid during 2019. At the end of 2019, the market price per share of common stock was 17.50. Required: 1. Compute Mononas basic earnings per share for 2019. 2. Compute the price/earnings ratio for 2019.

- Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.

- Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.