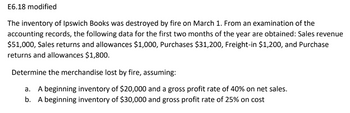

E6.18 modified The inventory of Ipswich Books was destroyed by fire on March 1. From an examination of the accounting records, the following data for the first two months of the year are obtained: Sales revenue $51,000, Sales returns and allowances $1,000, Purchases $31,200, Freight-in $1,200, and Purchase returns and allowances $1,800. Determine the merchandise lost by fire, assuming: a. A beginning inventory of $20,000 and a gross profit rate of 40% on net sales. b. A beginning inventory of $30,000 and gross profit rate of 25% on cost

E6.18 modified The inventory of Ipswich Books was destroyed by fire on March 1. From an examination of the accounting records, the following data for the first two months of the year are obtained: Sales revenue $51,000, Sales returns and allowances $1,000, Purchases $31,200, Freight-in $1,200, and Purchase returns and allowances $1,800. Determine the merchandise lost by fire, assuming: a. A beginning inventory of $20,000 and a gross profit rate of 40% on net sales. b. A beginning inventory of $30,000 and gross profit rate of 25% on cost

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 10E: Gross Profit Method: Estimation of Theft Loss You are requested by a client on September 28 to...

Related questions

Question

Transcribed Image Text:E6.18 modified

The inventory of Ipswich Books was destroyed by fire on March 1. From an examination of the

accounting records, the following data for the first two months of the year are obtained: Sales revenue

$51,000, Sales returns and allowances $1,000, Purchases $31,200, Freight-in $1,200, and Purchase

returns and allowances $1,800.

Determine the merchandise lost by fire, assuming:

a. A beginning inventory of $20,000 and a gross profit rate of 40% on net sales.

b. A beginning inventory of $30,000 and gross profit rate of 25% on cost

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage