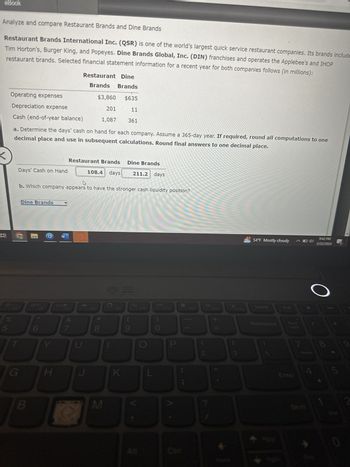

Restaurant Brands International Inc. (QSR) is one of the world's largest quick service restaurant companies. Its brands include Tim Horton's, Burger King, and Popeyes. Dine Brands Global, Inc. (DIN) franchises and operates the Applebee's and IHOP restaurant brands. Selected financial statement information for a recent year for both companies follows (in millions): Restaurant Dine Brands Operating expenses Depreciation expense Cash (end-of-year balance) Brands $3,860 $635 201 11 1,087 361 a. Determine the days' cash on hand for each company. Assume a 365-day year. If required, round all computations to one decimal place and use in subsequent calculations. Round final answers to one decimal place. Restaurant Brands Dine Brands Days' Cash on Hand 108.4 days 211.2 days b. Which company appears to have the stronger cash liquidity position? Dine Brands

Q: Required information [The following information applies to the questions displayed below] On…

A: Bad debt means where the amount receivable from debtor is not expected to realize and hence it…

Q: Prepare journal entries for the transactions above. (Ignore cost of goods sold entries and…

A: Journal entries are fundamental records in accounting, documenting financial transactions by…

Q: Augusta Sports manufactures baseball caps. The company uses standards to control costs. The labor…

A: The variance is the difference between the standard and applied overhead costs. The variance is…

Q: Symphony Electronics produces wireless speakers for outdoor use on patios, decks, etc. Their most…

A: This budget is prepared to estimate the number of units to be produced for desired sales during the…

Q: Compute BMX's amounts for each of these four taxes as applied to the employee's gross earnings for…

A: Taxes on Social Security:The Federal Insurance Contributions Act (FICA) mandates a payroll tax and…

Q: Mack Precision Tool and Die has two production departments, Fabricating and Finishing, and two…

A: Cost allocation to support departmentsWhen the company has more departments, there will be a…

Q: Foam Products, Incorporated, makes foam seat cushions for the automotive and aerospace industries.…

A: ACTIVITY BASED COSTINGActivity Based Costing is a Powerful tool for measuring…

Q: Edwards manufactures small tables in its Processing Department. Direct materials are added at the…

A: Equivalent unit refers as the number of units that would have been produced given amount of total…

Q: Schedule of cash collections of accounts receivable Pampered Pal Inc., a pet supplies distributor,…

A: The budget is prepared to estimate the requirements during the period.The cash collection schedule…

Q: Ms. Suzanne Morphy is a full time architect. She is also sells vegetables on the side from a small…

A: The subject of discussion is a lady named Suzanne Morphy and her financial difficulties. She is a…

Q: Required information [The following information applies to the questions displayed below.] Shadee…

A: The budget is a financial plan prepared by the company that comprises of the future cash inflows and…

Q: Operating income and tax rates for B.J. Company's first three years of operations were as follows:…

A: Deferred Tax:A deferred tax adjustment is prevalent where there is a temporary difference in the…

Q: Use workshee ckson 2018, he at $8,300,000. directed distribu as follows: $22,000 to the local…

A: Income tax:The income tax refers to the amount that is paid by the taxpayer to the tax authority of…

Q: Pharoah Doors, Inc. is in the process of setting a target price on its newly designed patio door.…

A: Absorption costing is a method of costing in which product cost is calculated by adding direct…

Q: Shadee Corporation expects to sell 580 sun shades in May and 400 in June. Each shade sells for $134.…

A: A selling and administrative expense budget is prepared to estimate the cost to be incurred towards…

Q: Newark Company has provided the following information: • Cash sales, $450,000 • Credit sales,…

A: The cash flow statement is a report that outlines the money coming in and going out of a business…

Q: Rothschild Chair Company, Incorporated, was indebted to First Lincoln Bank under a $20 million, 10%…

A: Journal entry records the accounting transactions of a business in a journal book. All the business…

Q: Orange Corporation has two divisions: Fruit and Flower. The following information for the past year…

A: Return on investment helps in measuring the performance by evaluating the profit and efficiency of…

Q: What is the tax implication if the employment is one of contract of service rather than contract for…

A: The tax implications for you differ depending on whether you're considered an employee (contract of…

Q: Sandhill Inc. has 4 product lines: sour cream, ice cream, yogurt, and butter. Demand of individual…

A: The incremental analysis is performed to analyze the effect of decision on the business or its…

Q: Bonita Company signed a long-term noncancelable purchase commitment with a major supplier to…

A: A journal entry is used to record a business transaction in the company's accounting records.…

Q: Chamberlain Enterprises Incorporated reported the following receivables in its December 31, 2024,…

A: Income statement:An income statement stands for the statement that shows profits and loss of the…

Q: On February 3, Year 1, Teel Corporation enters into a subscription contract with several subscribers…

A: The objective of this question is to understand how to account for the subscription contract entered…

Q: Nick's Novelties, Incorporated, is considering the purchase of new electronic games to place in its…

A: Annual cash inflows = Annual Net operating income + DepreciationPayback period = Initial investment…

Q: You have the following information for Blossom Company. Blossom Company uses the periodic method of…

A: Cost of goods sold = 216,994Gross profit = 170,760Explanation:Compute the total number of units…

Q: (a) Sheridan Company retires its delivery equipment, which cost $47,790. Accumulated depreciation is…

A: Depreciation is considered an expense charge on the value of the asset. It can be calculated by…

Q: please double underline need answer for all or skip answer with explanation , computation for each…

A: Variable overhead efficiency variance :Variable overhead efficiency variance is the difference…

Q: Accouting Current Attempt in Progress Blossom Company purchases a patent for $158,000 on January 2,…

A: Journal Entry :— It is an act of recording transactions in books of account when transaction…

Q: Blossom Paints makes various interior and exterior paints for its customers, but its current focus…

A: Operation costing method employed to determine the value of a product at each process or stage of…

Q: Chef Erin completes her inventory on Thursday evening and finds that she has $11, 500 in product on…

A: The objective of the question is to calculate the cost of goods sold (COGS) during a specific time…

Q: Exercise 20-17 (Algo) Preparation of cash budgets (for Kayak Company budgeted the following cash…

A: The cash budget is prepared to record the cash receipts and cash disbursements during the period.…

Q: Lane Company manufactures a single product requiring a great deal of hand labor. Overhead cost is…

A: Overhead expenses are running business expenses that are not directly related to providing a given…

Q: Mills Corporation acquired as a long-term investment $220 1 of 6% bonds, dated July July Company…

A: Bonds:The bond is the financial instrument that is used by the company to get the loan amount so…

Q: vvv Limited purchased a machine for $300,000 cash on 1 July 2005. The useful life of the machine is…

A: As per IAS 16 Property, Plant and Equipment outlines the accounting treatment for most types of…

Q: Carla Vista Inc. presented the following data: Net Income Preferred shares: 62,900 shares…

A: A stock split is when a company decides to divide its shares into shares, which results in more…

Q: he following information pertains to Hagen Metal Works' ending inventory for the current year. Unit…

A: Individual item method: Using the individual item method, the inventory is valued at a lower of cost…

Q: 2. Compute the Cost of Goods Available for Sale, Cost of Goods Sold, and Cost of Ending Inventory…

A: Under the FIFO method, the inventory that is purchased at first is sold first. So, in a period of…

Q: Problem 8-63 (LO 8-1) (LO 8-3) (Algo) [The following Information applies to the questions displayed…

A: Answer:- The whole amount of money earned by a taxpayer that is subject to a mandatory tax levied by…

Q: Augusta Sports manufactures baseball caps. The company uses standards to control costs. The labor…

A: The objective of the question is to calculate the variable overhead efficiency variance for Augusta…

Q: o Company produces a product that requires 3.0 standard pounds per unit at a standard price of $6.00…

A: Income Statement -An organization's income statement, which shows profit and loss for an accounting…

Q: Chip has an accrual - method, calendar - year sole proprietorship. On January 1, 2019, he creat…

A: Accrual Method -Accounting for large organizations requires the accrual approach, sometimes called…

Q: Which of the following is not considered a type of equipment? A B C Office supplies. Filing cabinet.…

A: Office supplies are the consumable items such as paper, pen, pencil, stapler, cloth etc to be used…

Q: Shibby Shades Incorporated manufactures artistic frames for sunglasses. Talia Demarest, controller,…

A: The production budget indicates the units that are required to be produced to meet the sales…

Q: Determine the equivalent units using the first-in, first-out costing method

A: FIFO is the method used to calculate the value of ending inventory of a business. FIFO states the…

Q: Irwin, Incorporated constructed a machine at a total cost of $35 million. Construction was completed…

A: Dear student,Part 1: Answer:The journal entry relating to the machine for 2024 would be as follows:…

Q: Bergo Bay's accounting system generated the following account balances on December 31. The company's…

A: Solution:-The query concerns financial accounting and centers on Bergo Bay Company's accounting…

Q: am. 127.

A: The objective of the question is to calculate the weighted-average number of common shares…

Q: Instruction: Do the initial transaction of accounts. Write your answer on yellow paper. Submit this…

A: The objective of the question is to understand the financial transactions of Olive Cañete's business…

Q: eBook Video Print Item Classify each of the accounts listed below as assets, liabilities, owner's…

A: The objective of the question is to classify each account into one of the five categories: assets,…

Q: Olive Company makes silver belt buckles. The company's master budget appears in the first column of…

A: The flexible budget is prepared for different units of production on the basis of variable cost rate…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- Conducting a Financial Ratio Analysis on HP INC. Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. In Chapter 3, we looked at Dunkin' Brands' financial statements. In this chapter, we will use financial Internet websites (specifically, www.morningstar.com and www.google.com / finance) to analyze HP Inc., a computer hardware company. Once on either website, you simply enter HP Inc.'s ticker symbol (HPQ) to obtain the financial information needed. The text mentions that financial statement analysis has two major components: a trend analysis, where we evaluate changes in key ratios over time, and a freer analysis, where we compare financial ratios with firms that are in the same industry and/or line of business. We will do both of these types of analysis in this problem. Through the Morningstar website, you can find the firm's financials (Income Statement, Balance Sheet, and Cash Flow) on an annual or quarterly basis for the five most recent time periods. In addition, the site contains Key Ratios (Profitability, Growth, Cash Flow, Financial Health, and Efficiency) for 10 years. We will use the Key Ratios on this site to conduct the firm's trend analysis. (At the bottom of the screen you will see that you can click "Glossary to find definitions for the different ratios For example, Morningstar's Financial Leverage ratio is the same as the Equity multiplier that we use in the textbook.) On the Google Finance site, you can find the firms financial statements for the four most recent years or the five most recent quarters and key financial data for related companies for the most recent year or quarter. We will use the related companies' annual data to conduct the firm's peer analysis. Notice that when you go to the "Related Companies" screen, you can "add or remove columns." Click on that phrase, and you can check which peer data items you'd like to show on tire computer screen. Also, once you have chosen the data, you can click on a term, and the companies will be ranked in either ascending or descending order for tire specific term selected. 6. From the Google Finance site, look at HP's profitability ratios (as measured by its profit margin, ROA, and ROE). How do these ratios compare with those of its peers?Conducting a Financial Ratio Analysis on HP INC. Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. In Chapter 3, we looked at Dunkin' Brands' financial statements. In this chapter, we will use financial Internet websites (specifically, www.morningstar.com and www.google.com/finance) to analyze HP Inc., a computer hardware company. Once on either website, you simply enter HP Inc.'s ticker symbol (HPQ) to obtain the financial information needed. The text mentions that financial statement analysis has two major components: a trend analysis, where we evaluate changes in key ratios over time, and a freer analysis, where we compare financial ratios with firms that are in the same industry and/or line of business. We will do both of these types of analysis in this problem. Through the Morningstar website, you can find the firm's financials (Income Statement, Balance Sheet, and Cash Flow) on an annual or quarterly basis for the five most recent time periods. In addition, the site contains Key Ratios (Profitability, Growth, Cash Flow, Financial Health, and Efficiency) for 10 years. We will use the Key Ratios on this site to conduct the firm's trend analysis. (At the bottom of the screen you will see that you can click "Glossary" to find definitions for the different ratios. For example, Morningstar's Financial Leverage ratio is the same as the Equity multiplier that we use in the textbook.) On the Google Finance site, you can find the firms financial statements for the four most recent years or the five most recent quarters and key financial data for related companies for the most recent year or quarter. We will use the related companies' annual data to conduct the firm's peer analysis. Notice that when you go to the "Related Companies" screen, you can "add or remove columns." Click on that phrase, and you can check which peer data items you'd like to show on tire computer screen. Also, once you have chosen the data, you can click on a term, and the companies will be ranked in either ascending or descending order for the specific term selected. 1. Looking at Morningstar's Financial Health ratios, what has happened to HPs liquidity position over the past 10 years?Conducting a Financial Ratio Analysis on HP INC. Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. In Chapter 3, we looked at Dunkin' Brands' financial statements. In this chapter, we will use financial Internet websites (specifically, www.morningstar.com and www.google.com/finance) to analyze HP Inc., a computer hardware company. Once on either website, you simply enter HP Inc.'s ticker symbol (HPQ) to obtain the financial information needed. The text mentions that financial statement analysis has two major components: a trend analysis, where we evaluate changes in key ratios over time, and a freer analysis, where we compare financial ratios with firms that are in the same industry and/or line of business. We will do both of these types of analysis in this problem. Through the Morningstar website, you can find the firm's financials (Income Statement, Balance Sheet, and Cash Flow) on an annual or quarterly basis for the five most recent time periods. In addition, the site contains Key Ratios (Profitability', Growth, Cash Flow, Financial Health, and Efficiency) for 10 years. We will use the Key Ratios on this site to conduct the firm's trend analysis. (At the bottom of the screen you will see that you can click "Glossary to find definitions for the different ratios. For example, Morningstar's Financial Leverage ratio is the same as the Equity multiplier that we use in the textbook.) On the Google Finance site, you can find the firm's financial statements for the four most recent years or the five most recent quarters and key financial data for related companies for the most recent year or quarter. We will use the related companies' annual data to conduct the firm's peer analysis. Notice that when you go to the "Related Companies" screen, you can "add or remove columns, Click on that phrase, and you can check which peer data items you'd like to show on tire computer screen. Also, once you have chosen the data, you can click on a term, and the companies will be ranked in either ascending or descending order for tire specific term selected. 8. From tire information gained in question 7 and using the DuPont analysis, what are HP's strengths and weaknesses compared to those of its competitors?

- Conducting a Financial Ratio Analysis on HP INC. Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. In Chapter 3, we looked at Dunkin' Brands' financial statements. In this chapter, we will use financial Internet websites (specifically, www.morningstar.com and wnvcv.google.com/finance) to analyze HP Inc., a computer hardware company. Once on either website, you simply enter HP Inc.'s ticker symbol (HPQ) to obtain the financial information needed. The text mentions that financial statement analysis has two major components: a trend analysis, where we evaluate changes in key ratios over time, and a peer analysis, where we compare financial ratios with firms that are in the same industry and/or line of business. We will do both of these types of analysis in this problem. Through the Morningstar website, you can find the firm's financials (Income Statement, Balance Sheet, and Cash Flow) on an annual or quarterly basis for the five most recent time periods. In addition, the site contains Key Ratios (Profitability, Growth, Cash Flow, Financial Health, and Efficiency) for 10 years. We will use the Key Ratios on this site to conduct the firm's trend analysis. (At the bottom of the screen you will see that you can click "Glossary to find definitions for the different ratios For example, Morningstar's Financial Leverage ratio is the same as the Equity multiplier that we use in the textbook.) On the Google Finance site, you can find the firms financial statements for the four most recent years or the five most recent quarters and key financial data for related companies for the most recent year or quarter. We will use the related companies' annual data to conduct the firms peer analysis. Notice that when you go to the "Related Companies" screen, you can add or remove columns. Click on that phrase, and you can check which peer data items you'd like to show on tire computer screen. Also, once you have chosen the data, you can click on a term, and the companies will be ranked in either ascending or descending order for the specific term selected. 7. From the Google Finance site, use the DuPont analysis to determine the total assets turnover ratio for each of tire peer companies. (Hint ROA = Profit margin Total assets turnover.) Once you've calculated each peer 's total assets turnover ratio, then you can use the DuPont analysis to calculate each peer's equity multiplier.Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Digitized Corp. and Very Network, Inc. and have assembled the following data. LOADING... (Click to view the income statement data.) Data Table Selected income statement data for the current year: Digitized Very Network Net Sales Revenue (all on credit) $418,290 $494,940 Cost of Goods Sold 210,000 256,000 Interest Expense 0 15,000 Net Income 62,000 70,000 (Click to view the balance sheet and market price data.) Data Table Selected balance sheet and market price data at the end of the current year: Digitized Very Network Current Assets: Cash $24,000 $21,000 Short-term Investments 42,000 19,000 Accounts Receivables, Net 36,000 46,000 Merchandise Inventory 67,000 98,000 Prepaid Expenses 22,000 18,000 Total…Analyze and compare Amazon.com and Wal-Mart Amazon.com, Inc. (AMZN) is one of the largest internet retailers in the world. Wal-Mart Stores, Inc. (WMT) is the largest retailer in the United States. Amazon and Wal-Mart compete in similar markets; however, Wal-Mart sells through both traditional retail stores and the internet, while Amazon sells only through the internet. Interest expense and income before income tax expense from the financial statements of both companies for two recent years follow (in millions): Amazon Walmart Year 2 Year 1 Year 2 Year 1 Interest expense $484 $459 $2,548 $2,461 Income (loss) before income tax expense 3,892 1,568 21,638 24,799 a. Compute the times interest earned ratio for both companies for the two years. Round your answers to one decimal place. Amazon Walmart Year 2 Year 1 Year 2 Year 1 Times Interest Earned Ratio

- Analyze and compare Hilton and Marriott Hilton Worldwide Holdings, Inc. (HLT) and Marriott International, Inc. (MAR) are two of the largest hotel operators in the world. Selected financial information from recent income statements for both companies follows (in millions): a. Compute the times interest earned ratio for each company. Round to one decimal place. b. Which company appears to better protect creditor interest? Why?Conducting a Financial Ratio Analysis on HP INC. Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. In Chapter 3, we looked at Dunkin' Brands' financial statements. In this chapter, we will use financial Internet websites (specifically, www.morningstar.com and www.google.com/finance) to analyze HP Inc., a computer hardware company. Once on either website, you simply enter HP Inc.'s ticker symbol (HPQ) to obtain the financial information needed. The text mentions that financial statement analysis has two major components: a trend analysis, where we evaluate changes in key ratios over time, and a freer analysis, where we compare financial ratios with firms that are in the same industry and/or line of business. We will do both of these types of analysis in this problem. Through the Morningstar website, you can find the firm's financials (Income Statement, Balance Sheet, and Cash Flow) on an annual or quarterly basis for the five most recent time periods. In addition, the site contains Key Ratios (Profitability, Growth, Cash Flow, Financial Health, and Efficiency) for 10 years. We will use the Key Ratios on this site to conduct the firm's trend analysis. (At the bottom of the screen you will see that you can click "Glossary" to find definitions for the different ratios. For example, Morningstar's Financial Leverage ratio is the same as the Equity multiplier that we use in the textbook.) On the Google Finance site, you can find the firms financial statements for the four most recent years or the five most recent quarters and key financial data for related companies for the most recent year or quarter. We will use the related companies' annual data to conduct the firm's peer analysis. Notice that when you go to the "Related Companies" screen, you can "add or remove columns." Click on that phrase, and you can check which peer data items you'd like to show on tire computer screen. Also, once you have chosen the data, you can click on a term, and the companies will be ranked in either ascending or descending order for tire specific term selected. 2. Looking at Morningstar's Financial Health ratios, what has happened to HP's financial leverage position over tire past 10 years?Conducting a Financial Ratio Analysis on HP INC. Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. In Chapter 3, we looked at Dunkin' Brands' financial statements. In this chapter, we will use financial Internet websites (specifically, www.morningstar.com and www.google.com/finance) to analyze HP Inc., a computer hardware company. Once on either website, you simply enter HP Inc.'s ticker symbol (HPQ) to obtain the financial information needed. The text mentions that financial statement analysis has two major components: a trend analysis, where we evaluate changes in key ratios over time, and a peer analysis, where we compare financial ratios with firms that are in the same industry and/or line of business. We will do both of these types of analysis in this problem. Through the Morningstar website, you can find the firm's financials (Income Statement, Balance Sheet, and Cash Flow) on an annual or quarterly basis for the five most recent time periods. In addition, the site contains Key Ratios (Profitability, Growth, Cash Flow, Financial Health, and Efficiency) for 10 years. We will use the Key Ratios on this site to conduct the firm's trend analysis. (At the bottom of the screen you will see that you can click "Glossary" to find definitions for the different ratios. For example, Morningstar's Financial Leverage ratio is the same as the Equity multiplier that we use in the textbook.) On the Google Finance site, you can find the firms financial statements for the four most recent years or the five most recent quarters and key financial data for related companies for the most recent year or quarter. We will use the related companies' annual data to conduct the firm's peer analysis. Notice that when you go to the "Related Companies" screen, you can "add or remove columns." Click on that phrase, and you can check which peer data items you'd like to show on tire computer screen. Also, once you have chosen the data, you can click on a term, and the companies will be ranked in either ascending or descending order for tire specific term selected. 5. From the Google Finance site, look at HP's liquidity position (as measured by its current ratio). How does this ratio compare with those of its peers?

- Conducting a Financial Ratio Analysis on HP INC. Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. In Chapter 3, we looked at Dunkin' Brands' financial statements. In this chapter, we will use financial Internet websites (specifically, www.morningstar.com and www.google.com / finance) to analyze HP Inc., a computer hardware company. Once on either website, you simply enter HP Inc.'s ticker symbol (HPQ) to obtain the financial information needed. The text mentions that financial statement analysis has two major components: a trend analysis, where we evaluate changes in key ratios over time, and a peer analysis, where we compare financial ratios with firms that are in the same industry and/or line of business. We will do both of these types of analysis in this problem. Through the Morningstar website, you can find the firm's financials (Income Statement, Balance Sheet, and Cash Flow) on an annual or quarterly basis for the five most recent time periods. In addition, the site contains Key Ratios (Profitability, Growth, Cash Flow, Financial Health, and Efficiency) for 10 years. We will use the Key Ratios on this site to conduct the firm's trend analysis. (At the bottom of the screen you will see that you can click "Glossary" to find definitions for the different ratios. For example, Morningstar's Financial Leverage ratio is the same as the Equity multiplier that we use in the textbook.) On the Google Finance site, you can find the firms financial statements for the four most recent years or the five most recent quarters and key financial data for related companies for the most recent year or quarter. We will use the related companies' annual data to conduct the firm's peer analysis. Notice that when you go to the "Related Companies" screen, you can "add or remove columns." Click on that phrase, and you can check which peer data items you'd like to show on tire computer screen. Also, once you have chosen the data, you can click on a term, and the companies will be ranked in either ascending or descending order for the specific term selected. 4. Identify Google Finance's list of related companies to HP. Which is the largest in terms of market capitalization? Which is the smallest? Where does HT rank (in terms of market capitalization)?Krispy Kreme Doughnuts, Inc. (KKD) is a leading retailer and wholesaler of doughnuts. Krispy Kreme owns or franchises more than 1,100 stores where the “hot" light tells you if doughnuts are cooking. Dunkin* Brands Group, Inc. (DNKN) is a leading franchisor of doughnut (Dunkin' Donuts) and ice cream (Baskin-Robbins) shops with more than 20,000 stores worldwide. Selected financial statement information for a recent year for both companies follows (in thousands): a. Determine the days' cash on hand for each company. Round all calculations to one decimal place.b. Which company appears to have the stronger cash liquidity position?Go to www.google.com and search "reuters, markets, companies and best buy". Click on BBY.N and find all the ratios for best buy. How is the company performing in each ratio category presented in the website?